Different Techniques Which Are Used for Allocating Costs

Units Produced of B 20000. Methods of Costing In Manufacturing Organisations.

Making Better Decisions By Applying Mathematical Optimization To Cost Accounting An Advanced Approach To Multi Level Contribution Margin Accounting Sciencedirect

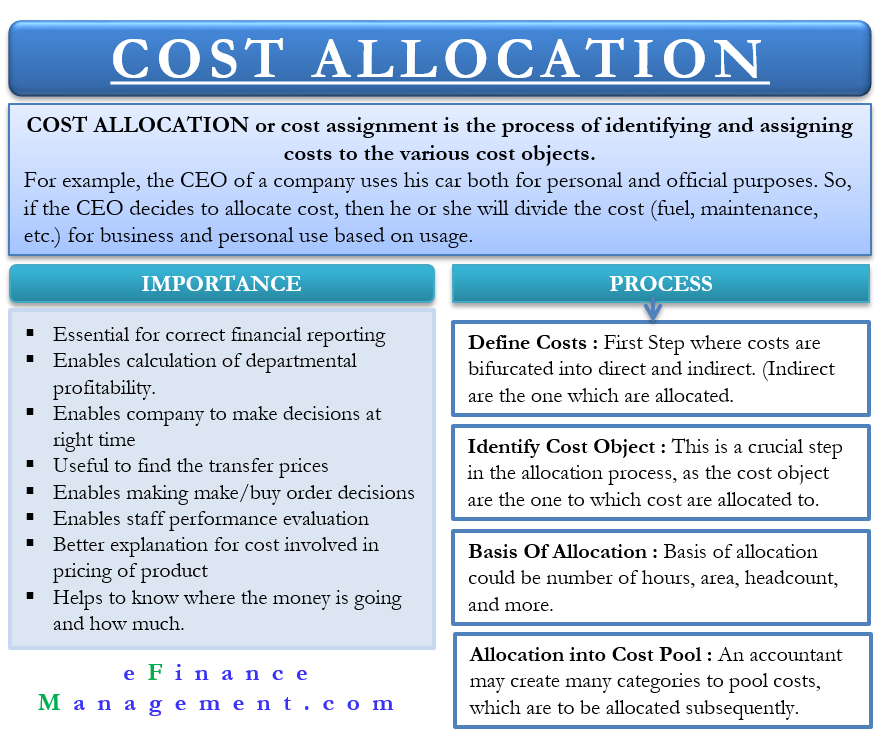

In order to make provision for these costs various tools and methods have been developed to allocate costs appropriately within the organization.

. However direct and step-down methods are simple to compute and easy to understand. Examples of Cost Allocation. There have been different methods of allocating the costs for joint products.

Why would a company use two different cost allocation rates. Specific Order Costing and Operations Costing. Youll need to use an allocation base that allows indirect costs to be apportioned reasonably and equitably.

Factory Rent 100000. Cost allocation methods In accordance with the various objectives of depreciation the cost or other value of an asset should be allocated over the service life in a systematic and rational pattern. If so a number of possible allocation methods have been used including the following.

The following are the main steps involved when allocating costs to cost objects. Why is Cost Allocation Important in Fleet Management. The dual-rate cost-allocation method is most us.

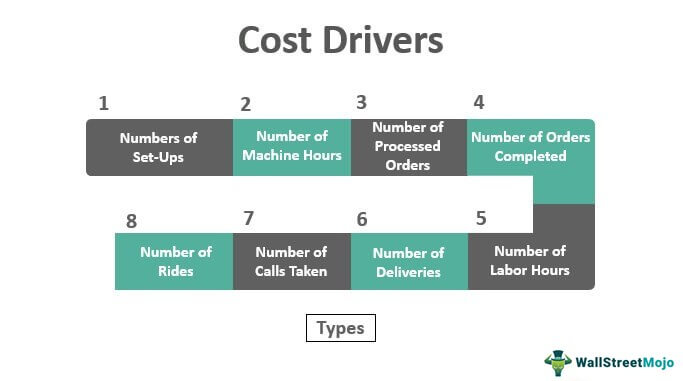

An effective cost allocation methodology enables an organisation. It is also the most complicated method as it requires solving a set of simultaneous linear equations. The department allocation A method of allocating costs that uses a separate cost pool and therefore a separate predetermined overhead rate for each department.

Out of the 3 allocation methods to allocate service support department cost to production department cost reciprocal method is said to be the most precise method. The direct method of cost allocation The step down method of cost allocation. This method uses some physical measurement units such as volume weight etc.

To identify what the costs of its transport services are and who should pay for it. The second method of allocating service department costs is the step method. Costs are apportioned based on the net sales reported by each entity.

Market or sales value method. The direct and sequential methods are the easiest and the most convenient ways of allocating the costs. Of units produced 50000.

Figuring out how to strike that balance. Two or more departments costs are to be allocated. But the costs should also be proportional to that responsibility.

Costs are separated into variable-cost and fixed-cost subpools. Allocate assign attribute apportion etc. Companies often select the best allocation system based on their manufacturing environments such as job order or process production.

In manufacturing organisations the principles of cost accumulation and their identification with products are more clear and visible and therefore the principles used by a manufacturing enterprise is often used by other organisations also for accumulating costs. Each costing method has its benefits and drawbacks from an accounting standpoint. The market or sales value method allocates a joint production cost on the basis of.

The different methods of cost allocation for join View the full answer. The first method the direct method is the simplest of the three. Cost allocation methods are used to resolve the accounting problem that specific costs do not always match specific outputs such as products or services.

A company produces two products namely A and B on the premises of the same factory. Units Produced of A 30000. Quantitative or physical unit method.

Two or more cost pools are to be allocated. What are the four cost. Identify cost objects The first step when allocating costs is to identify the cost objects for which the organization.

Answer 1 of 2. Simple Method Single-rate used when indirect costs benefit major functions to the same degree Multiple Allocation Base Method Two-rate separate rates for fringe and overhead Three-rate fringe overhead and GA used when indirect costs. These methods helps to us to allocate costs to joint products and allows us to determine the profit if any at split off.

Approach is similar to the plantwide approach except that cost pools are formed for each department rather than for the entire plant and a separate predetermined overhead rate is established for each. Methods to allocate joint production cost 1. This method allocates cost by explicitly including the mutual services rendered among all departments causes of under and over absorption of overhead.

The step-down method or known as sequential method allocates the costs of some service departments to. Cost Allocation Based on Sales. Allocating Service Overhead Costs Direct Method.

The direct method is the most widely-used method where it allocates each service departments total costs. Since high sales volume does not necessarily equate to high profits this approach can result in a low-profit entity being burdened with a substantial corporate allocation. Different Methods for Allocating Cont You may also have multiple rate structures.

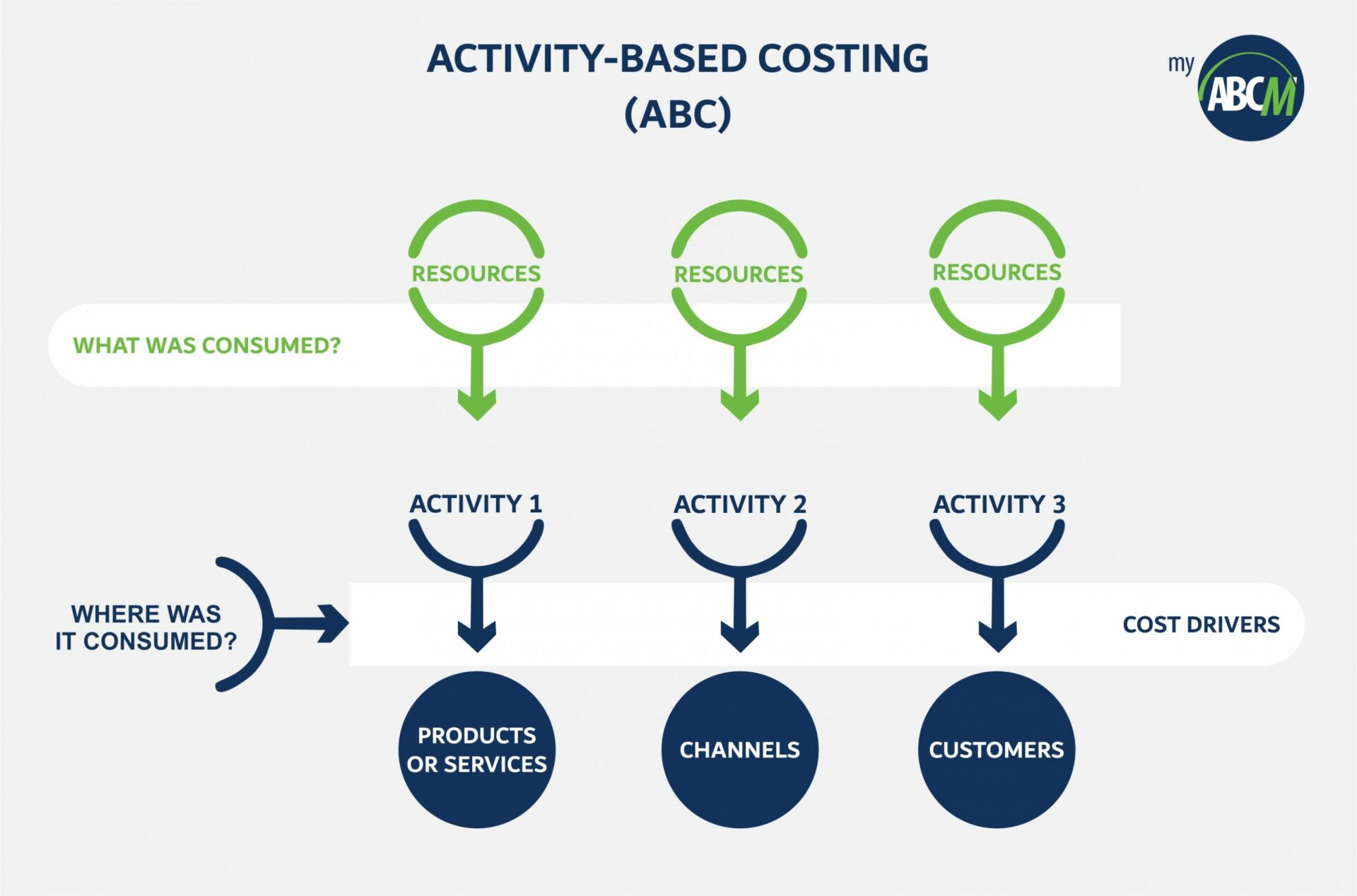

This process can be understood by way of the following example. Different cost allocation methods can involve basing the allocation on time physical measures such as staffing costs or on output. A few common cost allocation systems include absorption costing variable costing and activity-based cost allocation.

Cost allocation methods include. There are three methods for allocating service department costs. The best method for allocating overhead in construction is a way thats fair.

In cost accounting the single rate cost allocation method uses one cost rate to dictate the dollars that are allocated from a cost pool to a unit batch department or division. On the other hand the reciprocal method of allocating the costs is the most difficult and is rarely used by companies. Divide the total collected in the overhead GA or fringe pool by an appropriate allocation base.

Accumulate costs into a cost pool. In the case of support departments the rate allocates dollars to another department or division. The allocation should be based on the benefits brought to the contract or project and the method of allocation is the same for all indirect cost pools.

Two or more products are produced. Many different terms are used to describe cost allocation in practice. An algebraic method sometimes called the reciprocal method.

22 2 Methods of allocating support department costs Three different methods can from ACCT 3001 at Laurentian University. After all the idea is to allocate or distribute costs that each job shares responsibility for meaning the job either caused or benefited from the cost. The method selected for any specific asset or group of assets should reflect the.

The third method is the most complicated but also the most accurate. Ideally costs should be assigned to the user or usage that caused it.

Types Of Transportation Costs Download Scientific Diagram

Cost Allocations Of Service Departments Ppt Download

The Absorption Costing Method In Management Accounting Magnimetrics

Nr524 Week 3 Building Curriculum With A Qsen Framework Curriculum Conflict Resolution Good Communication

Cost Accounting Definition Types Objectives And Advantages

Cost Allocation Meaning Importance Process And More

Non Profit Proposal Template Stcharleschill Template Proposal Templates Business Plan Template Event Proposal Template

10 Practical Risk Management Techniques Risk Management Management Techniques Management

Three Manufacturing Costs Direct Material Cost Consist Of All Those Material That Can Be Identified With A Specific Product Example Wood Used In Manufacturing Ppt Download

3 Ways To Allocate Costs To Multiple Support Departments Direct Step Down And Reciprocal Methods Youtube

Difference Between Cost Allocation And Cost Apportionment With Comparison Chart Key Differences

Cost Object Meaning Advantages Types And More

Allocation Of Direct And Indirect Costs To Customers Download Table

Activity Based Costing Everything You Need To Know About The Abc Methodology Myabcm

The Absorption Costing Method In Management Accounting Magnimetrics

Cost Drivers Definition Examples Why It Is Important

Manufacturing Overhead Costs Traditional Cost System Download Table

Quickstudy Cost Accounting Laminated Reference Guide Cost Accounting Accounting Accounting Basics

Methods Of Allocating Service Department Cost To Producing Departments Qs Study

Comments

Post a Comment